Political turmoil around the world in recent years have led to serious energy supply disruptions. To save energy, many developed countries resort to temporary suspension of electricity supply. Some energy providers charge more for using electricity at certain hours of the day and offer lower rates at night. All these have caused disruptions to industrial and business activities and made energy storage all the more important.

|

|

|||||||||||||||||

| VFB | ||||||||||||||||||

|

|

|||||||||||||||||

What is vanadium redox flow battery?

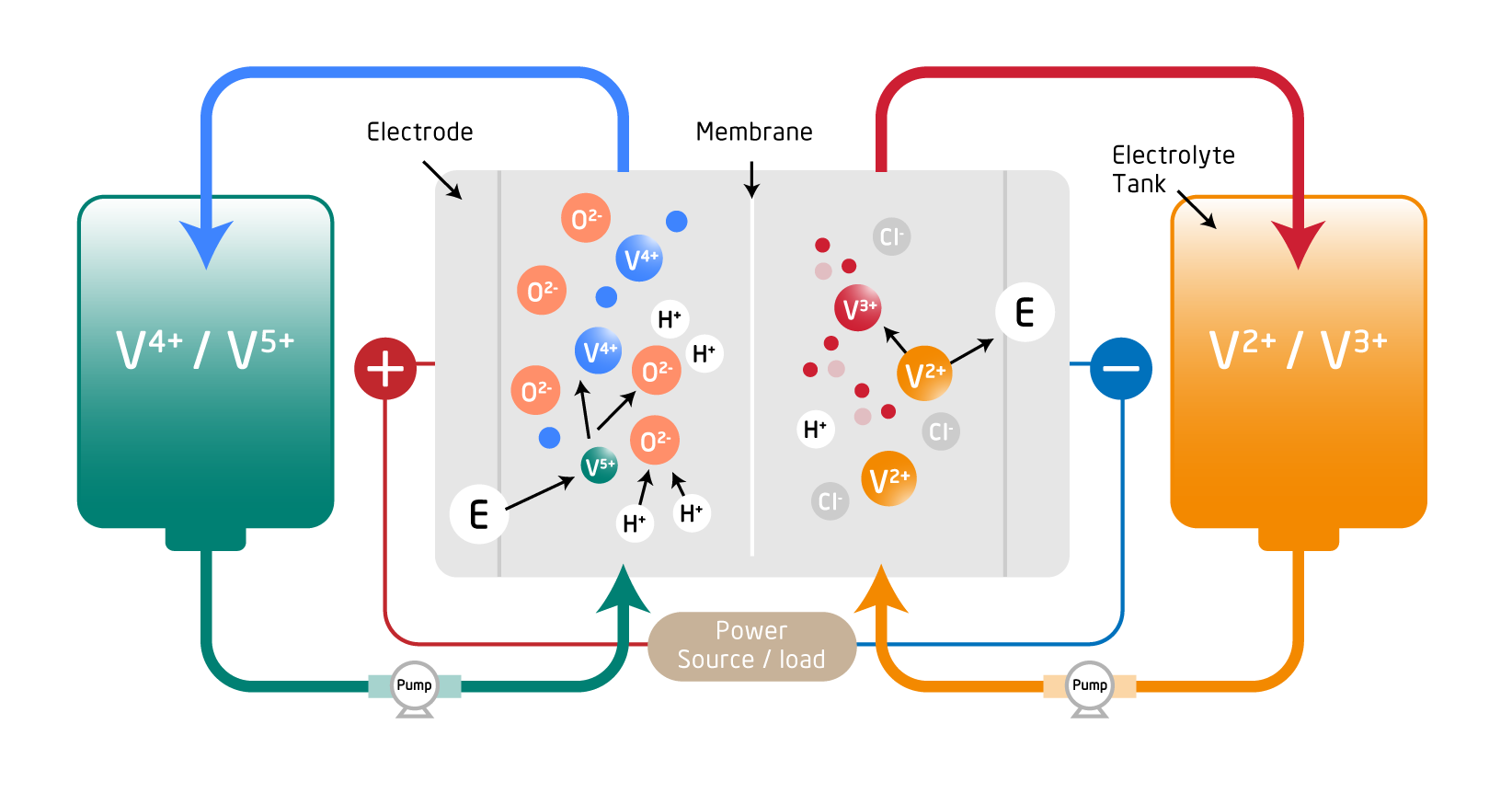

Among all energy storage technologies, vanadium redox flow battery (VFB) is the best performer, and it carries no explosion risk. VFB works by storing vanadium-based electrolyte in two tanks, with the difference between the tanks being the electrical charge of the vanadium (V5+, V4+ and V3+, V2+). This creates an electric potential between the anode and cathode, which is converted to electrical energy when they are pumped through the cell stacks.

Advantages

VFB has been in the market for more than 15 years. It is in use in over 50 countries and has been adopted by US military/navy bases. It is estimated that the size of the VFB market will grow at a compound annual rate of about 21% by 2026.

Long lifespan: >25 years

Safe, non-inflammable

Stationary use for a long time

Suitable for large capacity energy storage

Modular structure

Low carbon footprint & recyclable

High stability & flexibility

High roundtrip efficiency

Market value of VFB

In 2020, the global VFB market was worth US$194 million. Analysts estimate that the value of the market will double to US$734 million by 2027, representing a compound annual growth rate (CAGR) of 20.9%. In 2022, the VFB market in the US was estimated at US$51.9 Million. The market in China is expected to reach US$84.7 million by 2026. (CAGR, Compound Annual Growth Rate)

Technical comparisons

| VFBs | Lithium-ion battery | Fuel cell | |||||

| Lifespan | > 20,000 cycles (25+ years) | 1,000 – 6,000 cycles (2 - 6 years) | > 40,000 hours (10+ years) | ||||

| Fire & explosion risk | |||||||

| Scalability | Higher (more liquid, more capacity) | Lower (require an entirely separate unit) | Lower (require an entirely separate unit) | ||||

| Very low self-discharge rate & degradation | |||||||

| Reusable electrolyte | |||||||

| Roundtrip efficiency | 70% - 80% | 80% - 95% | 30% - 40% | ||||

| Long duration | |||||||

| High density but short lifespan | |||||||

| Very low levelised cost of storage | |||||||

| External fuel source required |

Integrated vanadium supply chain for VFB

Unity is optimistic about the future of vanadium. Striving to be a leading vertical fully integrated low-cost, high-purity vanadium producer, Unity has co-invested in a production base in Hunan that has a reserve of 300,000 tons of vanadium. Production on the site is expected to begin by 2023. Vanadium obtained from mining will be transported to the self-built production plant nearby for producing vanadium electrolyte solution, a substance crucial for the manufacturing of VFB.

Application of VFB

Large-scale production plant

Hospitals (backup power generation)

Military facilities

Connected to electric grid

Car charging station

Copyright ©2026 Unity Group. All rights reserved